|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Current Mortgage Refinance Rates in Pennsylvania: An In-Depth GuideRefinancing a mortgage can be a strategic financial move for homeowners in Pennsylvania. Understanding the current mortgage refinance rates and how they impact your financial landscape is crucial. Understanding Mortgage Refinance RatesThe term 'mortgage refinance rate' refers to the interest rate applied when replacing your existing mortgage with a new one. This process can help lower monthly payments, reduce interest over the loan's life, or provide cash for other expenses. Factors Affecting Refinance Rates

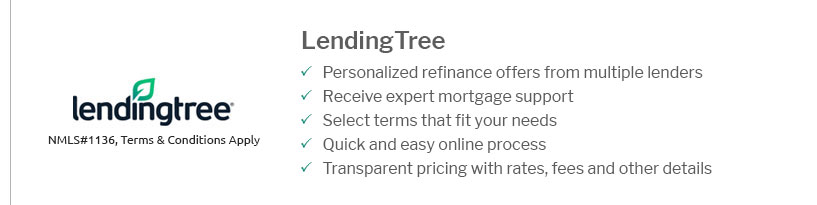

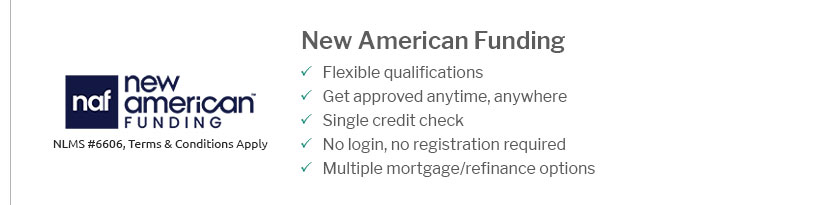

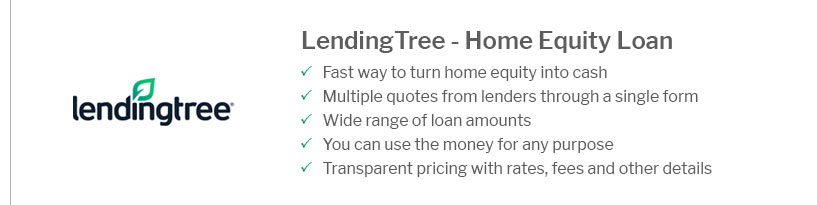

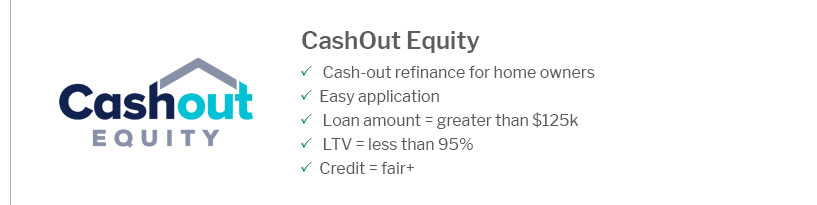

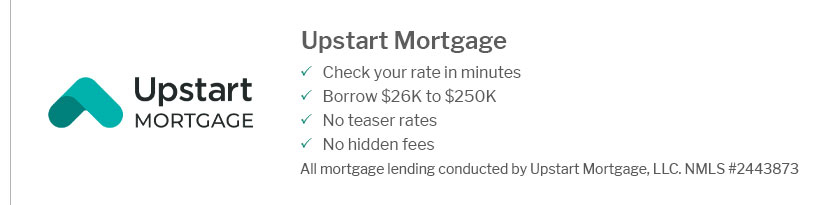

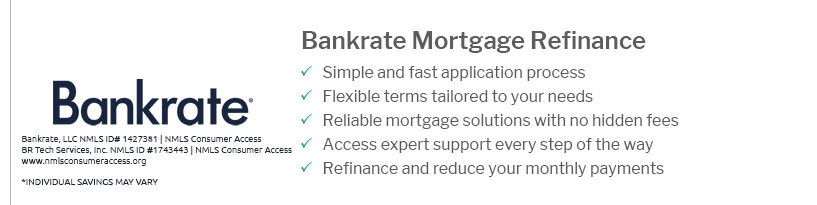

Benefits of RefinancingRefinancing offers multiple benefits, such as reducing monthly payments or altering the loan term to save on interest. Homeowners might also explore refinancing options to switch from an adjustable-rate to a fixed-rate mortgage, providing stability in payments. For those living in condominiums, navigating the refinancing process can be unique. Understanding condo refinance owner occupancy requirements is essential to ensure eligibility and secure the best rates. Current Trends in PennsylvaniaAs of the latest data, mortgage refinance rates in Pennsylvania have been relatively stable. However, they can fluctuate based on economic conditions and policy changes. Comparing LendersIt's vital to compare offers from multiple lenders. Each lender may offer different rates and terms, so it's worth shopping around to find the best deal. Using Online ToolsLeveraging online tools can help homeowners estimate potential savings and costs associated with refinancing. A mortgage estimator FHA can provide a detailed analysis tailored to specific financial situations. FAQs

In conclusion, staying informed about current mortgage refinance rates in Pennsylvania and understanding the factors that influence these rates can empower homeowners to make informed financial decisions. https://www.bankofamerica.com/mortgage/

Today's competitive mortgage rates ; Rate - 6.750% - 5.750% ; APR - 7.016% - 6.220% ; Points - 0.588 - 0.890 ; Monthly payment - $1,297 - $1,661. https://www.totalmortgage.com/locations/state/PA/mortgage-rates

The mortgage rates in Pennsylvania are as low as 6.000% for a 30-year fixed mortgage. These rates are ... https://www.lendingtree.com/home/mortgage/rates/pennsylvania/

Current 30 year-fixed mortgage refinance rates are averaging: 7.27% ...

|

|---|